Your wear’t must register a merchant account or solution KYC as you do to your OKX CEX. We double-take a look at exterior protection audits and its particular social networking presence. I in addition to trade to the program observe how it work in the day-to-go out things.

Hyperliquid – Episodes on the sensuous take off

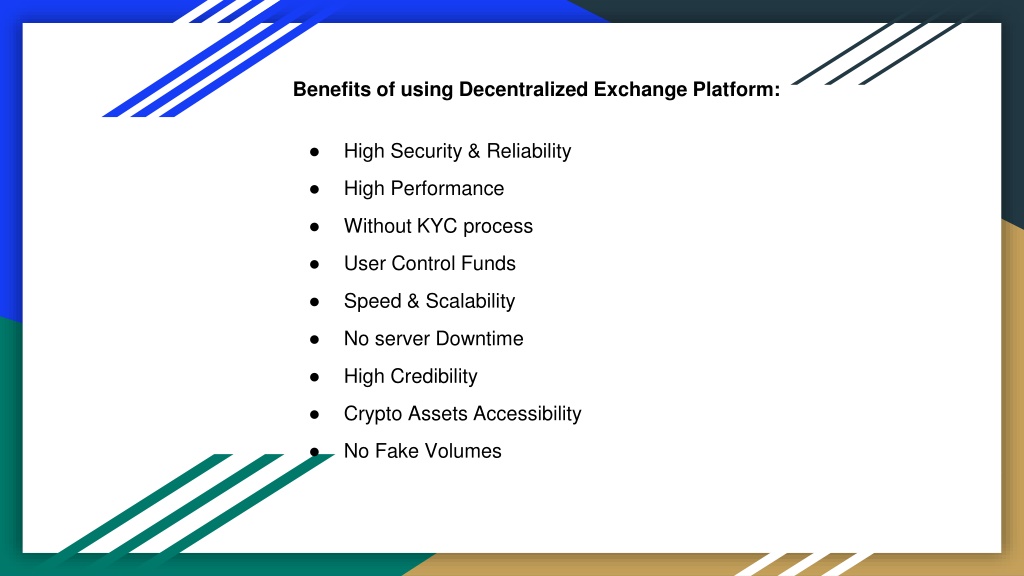

This type of , safe purchases represent a keen speeding up portion of your own electronic resource field, and therefore are groundbreaking the fresh lending products to enhance . Decentralized crypto exchanges (DEXs) try blockchain-dependent applications you to accentuate higher-scale hyperliquid trading out of crypto assets ranging from of many pages. They actually do one totally due to automated formulas, rather than the conventional method out of acting as economic intermediary anywhere between buyers and you may suppliers. Centralized transfers (CEXs) give high advantages of time investors, primarily using their highest trade quantities and strong exchangeability. Which setup enables punctual and effective exchange execution, that’s important when selecting an excellent crypto day change exchange, where short response to field activity can also be drastically effect profits. Decentralized exchanges (DEXs) operate using a dispensed network away from nodes, making certain the platform operates autonomously rather than just one section from incapacity otherwise control.

IDEX also offers an alternative trading platform that combines decentralized security with central speed and you will user experience. It hybrid design lets pages to experience the benefits of both planets, making it a stylish option for those individuals trying to a productive decentralized change sense. A unique ability from Bancor is actually its solitary-advantage liquidity provision, that allows users to help you sign up to exchangeability swimming pools without needing to give a matching group of possessions. That it simplifies the fresh liquidity supply process and decreases the chance of impermanent losings, a common topic in the antique liquidity swimming pools. Uniswap is amongst the best DeX platforms which was founded within the 2018 having fun with Ethereum Blockchain, a databases of data intended to be unhackable.

It’s including an industry in which consumers and you may sellers see to trade products. Automated Market Creator (AMM) DEXs such Uniswap and SushiSwap support positions as a result of exchangeability pools, deciding cost algorithmically centered on also have and you can consult. The new cons you to definitely result from decentralized replace play with and introduce difficulties in order to extensive adoption. These flaws determine DEX scalability, consumer experience, field exchangeability, plus the versatility of money. Centralized exchanges typically boast the quickest exchange performance. Because of the controlling the program system, CEXs can also be match deals inside instead demanding the transaction to be compensated to the blockchain.

- SynFutures try a decentralized perpetual exchange you to democratizes the brand new types industry.

- However they earn significantly more, if there is far more trading happening thanks to the pond.

- Having fun with a great DEX is one way you could potentially maintain authority more your own crypto and you may shell out adhere on the “not your own tips, perhaps not your crypto” motto.

Covered Crypto Tokens: A beginner’s Book

- Unlike relying on banking companies otherwise businesses, DEXs play with smart contracts and blockchain tech to make peer-to-peer trade you’ll be able to.

- Talk about the top 10 top decentralized crypto exchanges (DEX) out of 2024, and Uniswap, PancakeSwap, and you may Contour.

- Aerodrome along with obviously features its own token – $AERO and you will veAERO (the governance token).

- Furthermore, blockchain technology also have defense for suggestions protection or any other items regarding the net from Some thing.

Inside Sep 2021, Chinese authorities launched a capturing ban for the all crypto transactions and you can mining, evoking the cost of specific cryptocurrencies to-fall dramatically in the quick wake. But not, such as limitations are hard to impose, and crypto exchanges provides generated tens of billions inside the cash of places which have cryptocurrency prohibitions. At the same time, other governing bodies have to date taken a somewhat restricted method.

It’s and best if you check out the replace’s innovation team and read reading user reviews to judge reliability and you can results. As the decentralized programs, DEXs do not generally collect associate advice and that don’t individually report to tax government like the Internal revenue service. It’s the associate’s duty so you can report and you may spend taxes on the any deals while the necessary for their local legislation. DEXs are usually experienced safer when it comes to chance of thieves of hacking, because they do not hold associate fund. But not, CEXs offer additional security features including customer care and compliance which have regulatory standards, that is helpful according to associate requires. • Gemini doesn’t need people account minimums, therefore it is very easy to begin committing to cryptocurrency.

Because of the merging both innovation, simple issues from the physical world will likely be efficiently set. Additionally, blockchain tech also provide defense to own suggestions security or other items related to the net away from Anything. Options which can take advantage of blockchain usually have of numerous participants just who do not completely trust one another however, need interact transparently and you may securely. They cover frequent transactions or analysis transfers, and so they may need unique electronic identifiers, decentralized naming functions, and you can secure ownership possibilities. This type of solutions can also should remove guide efforts inside the resolving difficulties and conflicts, plus they must make it real-go out overseeing by bodies.

Samples of Common CEXs

While using the a great DEX, it is important to see the commission framework, as is possible dictate the exchange decisions. Inspite of the current market-wide downturn, the new h2o staking environment nonetheless makes up about more than thirty-five% of your full $88 billion DeFi TVL. Certain benefits state the opportunity of CBDCs to slice aside industrial banking institutions since the intermediaries deal dangers, mainly because banking institutions do a serious financial part by simply making and allocating borrowing from the bank (i.age., and make financing).

On the flip side, whenever hackers took $150M out of KuCoin within the 2020, the platform protected the losings and you will tightened their protection. A maker’s purchase can be perhaps not satisfied since there isn’t enough exchangeability in the market. With regards to security, Uniswap’s origin password are discover resource, therefore anyone can examine it to own pests and you can weaknesses. There’s and an insect bounty program for anybody who finds one prospective issues on the system.

Which have invisible limit sales to the Aster, you might place and cover-up the transaction dimensions and you can assistance to prevent front-running. WooFi are a keen onchain futures exchange system having a powerful purchase guide and several choices for one trading futures while the you love. The platform makes you execute multiple buy models, and limitation, market, stop-limitation, scaled, and stop-business orders.

In addition to, our Light-name DEX options is actually costs prices-energetic alternative for companies which have budgetary criteria. These types of ready-produced networks, that have pre-founded provides, will be deployed quickly with reduced innovation will set you back. Because the DEX technical continues to progress, Coinsclone stays just before industry trend, delivering transparent and you may effective change options.

That it combination allows people to select and select ranging from standards you to definitely give them an educated costs and exchangeability. A knowledgeable-decentralized change (DEX) first of all needs to be Uniswap. It has the advantage of having a basic program, so it is possible for novices to get going exchange. The price tag design is really simple, so there’s a mobile app to exchange on the go.

Already, a respected networks including Ethereum and you will Solana show you to definitely water staking can perform eventually changing exactly how users earn and you may experience the decentralized ecosystem. Being a bar representative, profiles have to found an excellent decentralized ID away from Albus Process, JPool’s tech companion, in the form of a low-fungible token. Proprietors Club participants can access the fresh Performed because the a keen NFT within the its crypto purses. JPool permits highest-yield to your water and you will head staking for pages to own complete power over their assets. As opposed to the typical h2o staking protocols offering its pages a great measly dos%-5% yearly payment produce, JPool now offers an even more lucrative bundle of up to 20% APY.

DEXs and never support the lead purchase of electronic possessions which have fiat currency, requiring profiles discover cryptocurrency through-other form first. Bancor is yet another celebrated to your-strings liquidity protocol that enables automatic, decentralized token replace for the Ethereum and round the blockchains. DEXs has gathered significant popularity, and therefore are gonna remain evolving.